Innovative Micro Equipment agreed to purchase Xilinx for $35 billion in stock, having the chipmaker into far more assorted and financially rewarding marketplaces and incorporating to its knowledge centre offerings.

Xilinx traders will get 1.7234 AMD shares for every Xilinx inventory they very own. That values Xilinx at about $143 a share, 25% extra than the closing rate on Monday and 35% higher than the cost ahead of news of a probable deal was reported earlier in October.

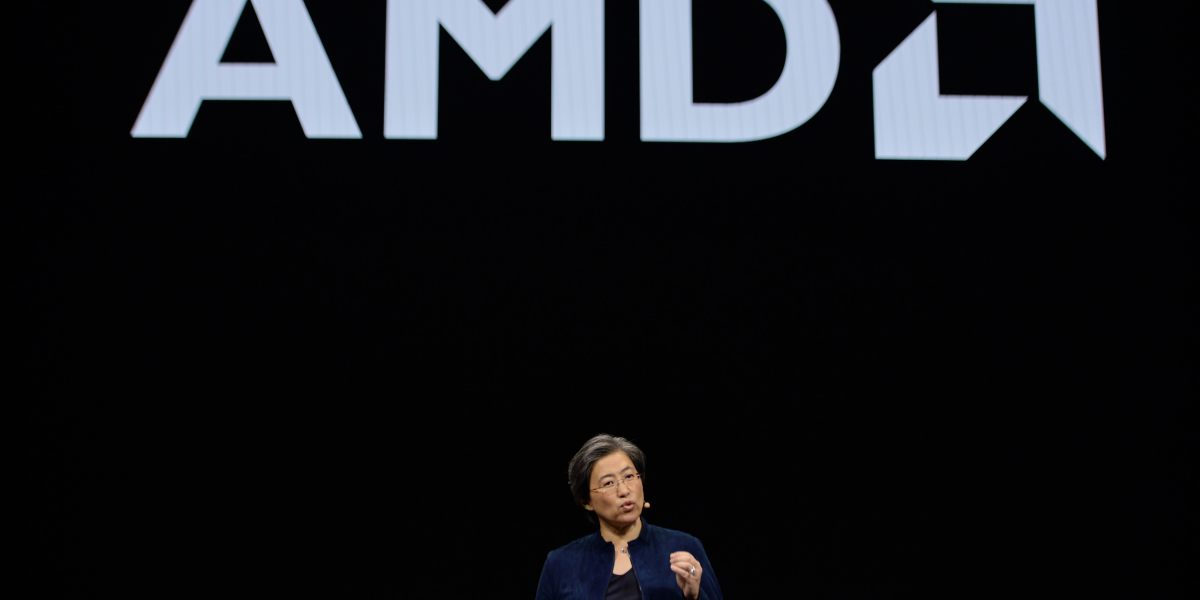

The deal is a coup for AMD Main Executive Officer Lisa Su, making a firm with a bigger investigation-and-development spending budget and a broader array of products and solutions to take on Intel Corp.

Considering that using more than in 2014 when AMD was in crisis, she has slashed financial debt and overseen the development of additional impressive processors. Earnings and earnings have surged and the stock has soared. Now Su is working with that currency to snap up a organization with complementary goods that create continual funds flow.

Some buyers and analysts ended up involved that AMD may possibly borrow heavily to pay back for a Xilinx acquisition, repeating highly-priced issues from more than a ten years in the past. The all-stock offer unveiled on Tuesday ought to tranquil those fears.

Q3 defeat

AMD also claimed third-quarter final results that defeat Wall Avenue estimates and gave a powerful earnings forecast for the existing time period, buoying self esteem in Su’s skill to soak up Xilinx and proceed increasing the put together organization. Income in the fourth quarter will be about $3 billion, a leap of 41% from a calendar year previously. On regular analysts had projected $2.62 billion. That follows an increase of 56% in the 3rd quarter owing to demand from customers for Computer system, gaming and data center processors. That is a distinction to Intel, which lately reported a shock drop in details middle chip product sales.

The acquisition nonetheless demands to be approved by shareholders and regulators, like authorities in China. AMD approximated that will consider about 18 months. When it closes, the offer will quickly boost AMD’s profitability, money flow and income advancement, AMD reported in a statement. AMD shareholders will personal 74% of the new firm. AMD will shell out Xilinx $1.5 billion if it terminates the offer, while Xilinx has agreed to shell out $1 billion if it calls off the transaction, in accordance to a regulatory filing.

“This is certainly a powerful blend that will produce significant value for all stakeholders, such as AMD and Xilinx shareholders who will profit from the long run development and upside probable of the put together corporation,” Su stated in the statement. She will be CEO and Xilinx’s Victor Peng will be president overseeing the Xilinx business enterprise and strategic expansion initiatives.

Using on Intel

The deal will give Su much more of the pieces she wants to break Intel’s stranglehold on the profitable marketplace for facts center computer system elements. Xilinx, based mostly in San Jose, California, helps make subject programmable gate arrays, or FPGAs. That variety of chip is special due to the fact its functionality can be altered by software, even following it’s been put in in a piece of machinery.

FPGAs are applied in wireless networks, so the invest in will give AMD new telecommunications customers just as that sector spends billions of pounds to construct fifth-generation, or 5G, services. Xilinx is also quickly growing in knowledge facilities, where by its chips speed up computing and support hook up servers. The other significant FPGA provider is Intel, which obtained its industry placement via the invest in of Altera Corp. in 2015.

Xilinx past 7 days described quarterly knowledge centre product sales were being up 30% and now account for 14% of complete earnings. Although it generates considerably less income than AMD, Xilinx is extra lucrative.

The transaction is partly driven by the development of significant cloud-computing providers these types of as Amazon.com Inc. and Alphabet Inc.’s Google. People corporations are spending seriously on new info centers to meet up with a surge in need for computing energy sent via the web. They’ve turn into major purchasers of server chips, which run countless numbers of personal computers that are packed into these details centers.

The cloud vendors are also racing to boost companies, these as search, with synthetic intelligence computer software, and numerous businesses are experimenting with setting up their personal hardware to do so. That’s putting higher strain on chipmakers to enhance their offerings.

At the same time, units in some of Xilinx’s traditional markets, such as automotive and networking, are increasingly getting on additional of the characteristics of personal computers. AMD now doesn’t have obtain to those prospects, whilst Intel does.

Credit Suisse and DBO Associates suggested AMD. Morgan Stanley recommended Xilinx.

Much more have to-browse tech protection from Fortune:

- What Silicon Valley needs from the 2020 election

- Powering authentic estate’s shock 2020 increase and what will come following

- Google suggests it is not a harmful monopoly. Listed here are its 4 important arguments

- What could improve at Google if the Department of Justice will get its way

- Teledentistry is filling a cavity remaining by the pandemic, but some caution it cannot substitute in-particular person visits