“The advantage that silicon photonics can carry is a small form component alternative, which can result in a compact sizing of the gadget in the car at the conclude,” says Kiyoul Yang, a postdoctoral researcher at Stanford College who focuses on photonic components. Numerous companies now use a lidar method based mostly on rotating mirrors, Yang claims, which necessitates the manufacture of discrete, highly-priced parts. “If every thing can be integrated in a chip in a little type factor, then everything can be made with a minimal value,” he suggests.

Yet again, Mobileye is not the only enterprise banking on FMCW, or lidar chips more broadly. But it does have a distinctive edge in that Intel previously has a silicon photonics manufacturing facility up and running in New Mexico. “Being ready to make an FMCW lidar calls for know-how, but also if you don’t have the specific fabs to create the lidar on a chip, it will become way too high priced. It become unwieldy,” states Shashua. He expects the cost of every single lidar SoC to be in the hundreds of pounds every, orders of magnitude more cost-effective than what devices charge currently.

Even if Mobileye’s output roadmap holds continual, a uncertain regulatory outlook could slow its timeline. Even now, it is producing nearer-term development as properly, saying at CES today that it would broaden its autonomous car or truck testing to Detroit, Paris, Tokyo, and Shanghai in 2020. (The spots are strategic each individual is in the vicinity of a auto producer that Mobileye provides self-driving systems for.) And it has made use of the thousands and thousands of vehicles with Mobileye onboard to crowdsource a map of practically 1 billion kilometers of the world’s roadways to day, processing 8 million kilometers each solitary working day. For all the attention Tesla receives, Mobileye is by significantly the industry share chief in the autonomous driving house.

That track record, and Intel’s deep pockets, will aid it in opposition to smaller opponents in the lidar SoC race. “I’m a massive believer that in the auto marketplace, trustworthiness is a significant differentiator,” says Mike Ramsey, an automotive analyst at Gartner. “Can I have faith in this seller to deliver on time, to provide in top quality? And Intel has the very critical aspect of being a very massive throat to choke if a thing goes erroneous. Don’t undervalue the benefit in that.”

Mobileye helps make up a modest percentage of Intel’s income overall. But alongside with the shopper computing group—that is, the chips that go into Pc and adjacent products—it’s the only segment that grew in the company’s most recent quarter. It’s particularly the sort of new territory that Intel needs to stake out aggressively to prevent a further smartphone-type miss.

“If you seem very long-term, a company like Intel needs to appear for new advancement domains. It is not quick to locate a person. You want to appear for a new sector that is the dimensions of hundreds of billions of pounds,” states Shashua, as very well as one that leverages Intel’s strengths. “Those domains are rare. We are in that area.”

XPU Marks the Spot

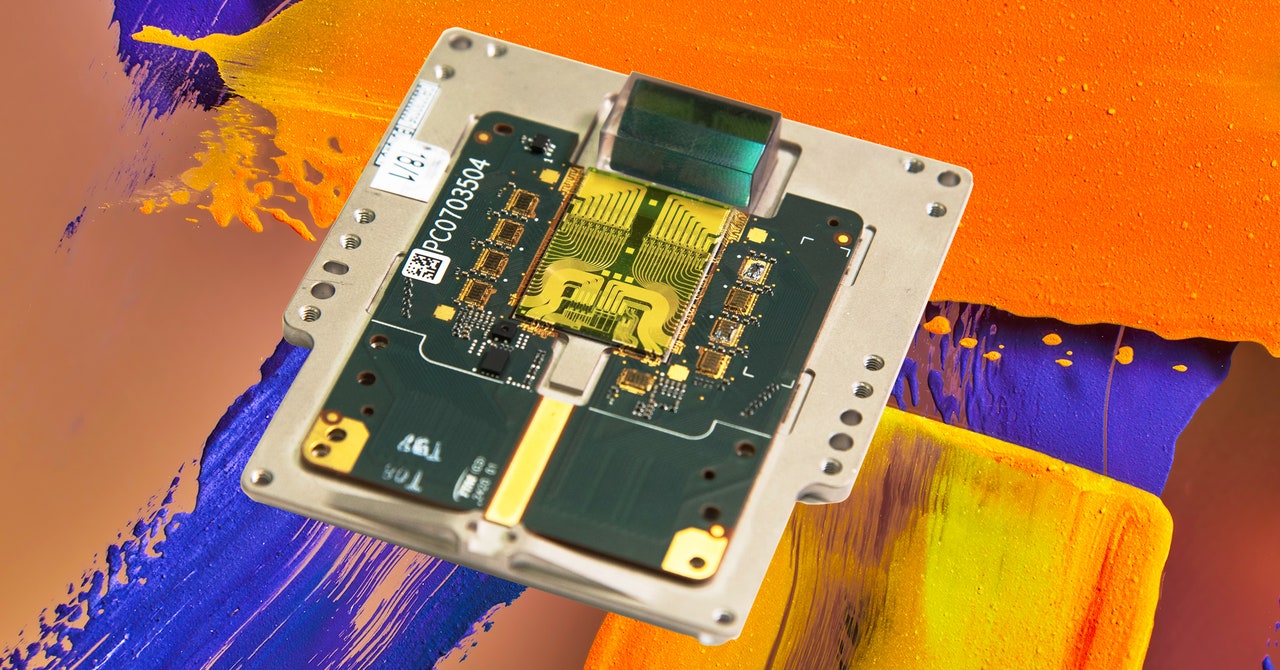

Mobileye’s lidar SoC is the sharpest example of what Intel calls its “XPU” strategy—that is, on the lookout past the CPU to computing in all of its a lot of sorts. The corporation launched its initially discrete graphics card previous tumble, has a dominant place in knowledge center processors, and in 2019 acquired AI chipmaker Habana Labs, which a couple of weeks in the past received business from Amazon Net Expert services to use its accelerators to practice deep learning models.

“At our heart we’re a computing firm,” states Gregory Bryant, who sales opportunities Intel’s shopper computing team. “We see this world wherever more and additional things want computing, extra and extra matters appear like a personal computer, not just the server or the Personal computer but the automobile, the residence, the manufacturing unit, the hospital. All those things need computing, and have to have intelligence.”

That broadening out comes at a time when Intel faces extra troubles than at any time to its classic company strains. Manufacturing delays have kept it stuck on a 10-nanometer system for fabricating its chips, though opponents have moved on to lesser kinds. The company’s main engineering officer, Murthy Renduchintala, remaining last summertime. And the hedge fund Third Position issued a scorching general public letter in late December, calling on Intel to “retain a reliable investment decision advisor to consider strategic alternatives, such as irrespective of whether Intel should continue to be an built-in machine maker and the probable divestment of particular unsuccessful acquisitions.”